It’s never been easier for consumers to shop around for a bank that meets their needs. It’s also not unusual for consumers to have accounts at more than one bank or even switch banks completely if they feel their current bank isn’t fulfilling their expectations.

Add to that the significant competition from the Big 4, start-ups, and disruptors. In fact, Deloitte Insights 2021 banking and capital markets outlook found that 67% of banking executives predict banking will move to non-finance platforms in only 5 years. Saying there is no time to waste is an understatement.

But as the world of retail banking continues to change, much of customer communications have not. Banks, and financial institutions alike, still push one-to-many text-heavy messages which are often overwhelming and difficult to parse. Customers are left dissatisfied and disengaged, impeding loyalty and business growth.

Given these challenges, the customer experience (CX) in banking must level-up to meet consumer expectations: speed and ease-of-use, wherever they are, and that’s digitally. According to the J.D. Power 2020 U.S. Retail Banking Satisfaction Study, nearly 3/4 of bank customers use an online portal or mobile app today — a major shift from the in-person banking customers endured pre-pandemic.

Why CX is important in banking and financial services

Banks are struggling with the consequences that stem from customer disengagement and know they need a new approach. Jim Marous of the Digital Banking Report found that over half of the world’s retail banks are making digital transformation and improving the customer experience their two major priorities for 2021,

Disengaged customers have a very high churn rate (up to 50% within the first 90 days of opening an account) and don’t make as many deposits or sign up for other products, like mortgages, as engaged customers. Engaged customers, however, move the needle. 70% of customers spend more when banks offer easy digital options and 71% say they’re happier and more likely to stay with their bank if their digital expectations are met, according to the Kony Digital Experience 2019 Index Survey. With such a significant improvement in spend and retention, it’s clear how important customer experience in banking and financial services remains.

How can you improve customer experience in banking?

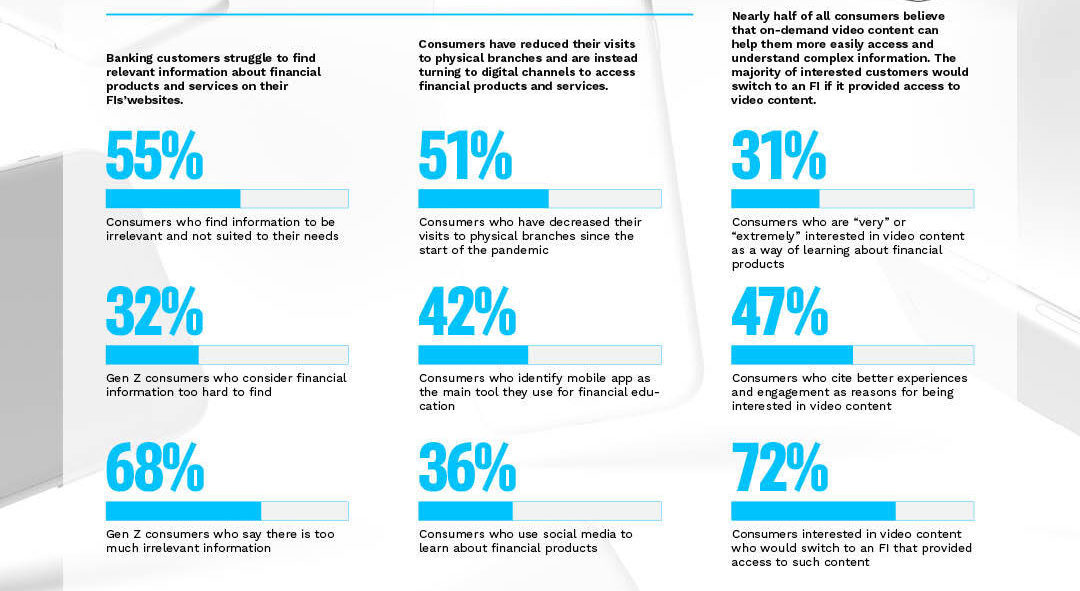

In a recent consumer survey conducted between PYMNTS.com, in collaboration with SundaySky, more than half of consumers feel that information on their financial institution’s websites is irrelevant to their needs with nearly 25% feeling that the information they’re looking for is often buried and too hard to find.

To re-engage disenchanted customers digitally and change behavior, the customer experience in banking must include clear and highly-tailored information that’s relevant to customers’ current financial situations, goals, and needs. Such a personalized customer experience should be delivered through video.

The PYMNTS survey also revealed that rich media content, such as on-demand video, is an appealing tool for accessing relevant information for about one-third of consumers responding with being “very” or “extremely” interested in using video for learning purposes. Further, 72% of them would be “very” or “extremely” likely to switch to FIs that provide rich media video content. Check out the infographic below for additional findings:

[For complete insights from the PYMNTS & SundaySky financial consumer survey, download it now]

The power of video to enhance digital customer engagement in banking

Video brings together three key components that catch viewer attention like nothing else: sight, sound and motion. According to studies, the average viewer remembers 95% of a message when it is watched, whereas only 10% when read. Additionally, users spend more time on a website that has video, and as a bonus, video adds the human element to customer communications when customers want it most – a huge benefit for banks as customers shift to digital from the in-person branch visits they’re accustomed to. All valuable insights that can be implemented when transforming the customer experience in banking and financial industries.

The problem banks have faced when trying to create video on their own is that the production and distribution of it are stale and limited: costly to create, difficult to keep up-to-date with ever-changing times and consumer expectations, and near impossible to scale.

But what if you could transform your video strategy leveraging video-powered experiences — modular video with agile and flexible scenes that generate the most relevant stories in real-time for customers, at scale?

Unleash the true potential of video with the Video Experience Platform

Video-powered experiences align with the need to guide consumer behavior and positively impact customer experience in retail banking, while minimizing costs and maximizing ROI. They help reduce customer support costs while enhancing customer loyalty and customer satisfaction.

Content modularity (think “building blocks”) and real-time video creates the most relevant video-powered experience possible. And they can be created at scale in the least expensive way possible. Scenes are reused across multiple video-powered experiences, like onboarding and account review, allowing banks to start with one moment in the customer journey and evolve over time.

Banks that have taken this approach with SundaySky have seen an 11.2% increase in NPS and a 12% lift in account funding. Even better, 80% of surveyed customers who viewed a video-powered experience felt highly appreciated.

Financial institutions that prioritize video for digital customer engagement see improved customer loyalty (11.2% increase in NPS) and better customer satisfaction (80% of video viewers feel highly appreciated).

Using video-powered experiences across the customer journey

The SundaySky Video Experience Platform can deliver video-powered experiences in as little as 8 weeks, accelerating time to value and customer engagement impact. By meeting customers where their data is, experiences can launch using available data or only the data needed to create experiences, and easily align with different contexts and goals.

Video-powered experiences are valuable across the customer journey. Some examples:

- Onboarding: provide guidance and education so new customers understand their banking account benefits and tools, and encourage them to sign up for digital tools

- Utilization: guide customer behavior to the next best digital action

- Educate: guide customer behavior towards using digital tools, and help customers understand the benefits of digital banking

- Expansion: help customers see the value of adding products to their accounts

Guide customer behavior in banking to adopt digital tools and to take the next-best digital action, throughout the customer journey.

Major retail banks, like Bank of America, use SundaySky’s platform to form long-lasting relationships with customers and video-powered experiences offer the security and support that banking customers demand. Learn more about how video-powered experiences for financial services can solve your most pressing consumer engagement challenges and improve the customer experience in banking.