Over the past few years, banks have begun transforming their customer experiences to prioritize an omnichannel approach and improve their digital interactions with customers. Consumers have adopted digital channels in droves – Bain Capital reports banking customers now handle 50 percent of their banking interactions through digital channels – and for banks that want a competitive advantage, they must optimize their digital customer experience at every touch point.

All brands – regardless of the industry – need to adopt a customer-centric approach that delivers a stellar experience to customers and differentiates the brand from competitors. For banks specifically, doing so assists them in meeting several strategic initiatives:

- Moving to top of wallet to be the consumer’s preferred method of payment;

- Earning more share of wallet to represent the majority of financial products within the consumer’s wallet; and

- Winning loyal, engaged customers.

Banks have the opportunity to use personalization to enhance and optimize the customer experience at every touch point, which unlocks new value opportunities as customers receive differentiated digital experiences. When relevant, real-time experiences are delivered via the most engaging digital medium – video – the message is as compelling as it is informative.

Differentiated experiences throughout the lifecycle

Banks can use personalized videos throughout the customer lifecycle – from within the first 90 days of a new customer relationship when banks have the best opportunity to encourage account activation and use, through the entire relationship as a means to earn customer trust and expand the relationship. Here’s how:

- Onboard and activate new customers

When banks use personalized video to welcome new customers and encourage account activation with a relevant and informative experience, they gain customer trust and increase brand engagement, loyalty and spending. The customer onboarding video can recommend actions that deliver a great customer experience, including scenes that highlight value-added services to make the most of a new account (such as autopay and e-statements), enrollment in loyalty programs, and promotions that drive up spending. - Deliver the first statement

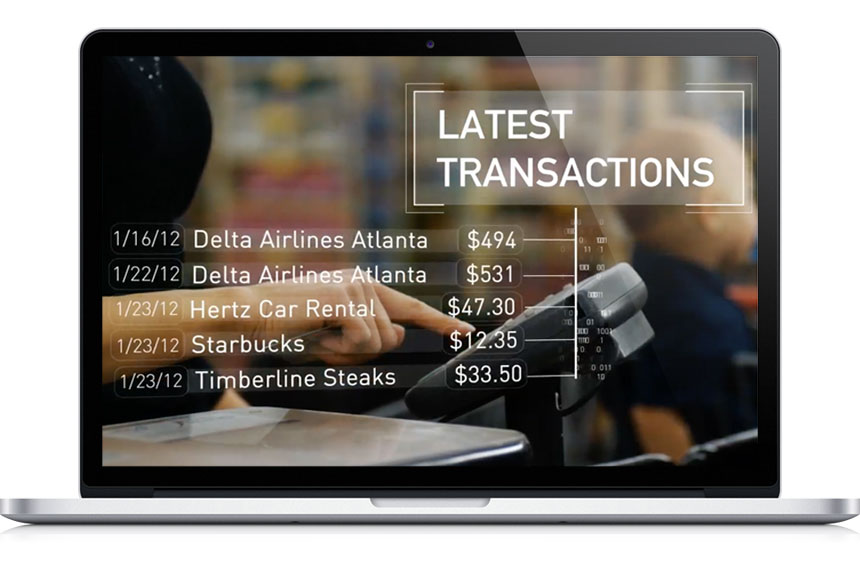

Extending the personalized video experience to the delivery of a customer’s first statement can reduce care costs, specifically by reducing the number and duration of statement-related calls from new customers. As with onboarding videos, personalized video statements can include promotions that drive up spending, uptake in value-added services and enrollment in loyalty programs. - Reminder for reward redemption

Customer reward redemption has significant influence over top-of-wallet status and total spending. Loyalty program marketing typically tailors communications, promotions and offers based on segment or persona-based attributes, but personalized video allows for one-to-one communication for even more memorable and effective brand engagement. For instance, a video scene could feature the customer’s points earned on recent transactions, followed by a scene of eligible and relevant redemption offers based on the customer’s recent life event (e.g., the purchase of a new car) or spending history (e.g., a frequent traveler). - Cross-sell and upsell services

To increase share of wallet and own as much of the customer’s wallet as possible, banks should tailor their marketing offers in order to maximize customer profitability. For example, banks can deliver a personalized video that shows where the customer is spending, and then offers a tailored promotion or reward for the spending behavior, such as a VIP airline credit card.

Data is available to enable rich customer insights and allow banks to connect with customers at an individual level. Personalized videos serve many use cases, all in support of meeting consumer demands for better digital experiences and maintaining a competitive, top-of-wallet advantage.