Estimating how much money you’ll need for a comfortable retirement can be overwhelming for investors and competing priorities for lifestyle often lead to a “set it and forget it” contribution strategy. With nearly half of Americans not believing they’re on track to retire with sufficient savings, this creates a significant opportunity for retirement service institutions to proactively engage and educate investors through digital planning tools and inspire them to take their financial health seriously while growing their confidence in meeting retirement savings goals.

Consumers’ low confidence in retirement savings creates significant opportunity for retirement service institutions to proactively engage and educate investors.

Like most brands today, there’s likely a considerable amount of resources focused on optimizing the digital experience for investors with the goal of building stronger, more valuable relationships. There are key times or – moments of consequence – that are high-stakes points in the customer journey when the customer relationship can be broken in an instant. These moments are often complex or difficult to explain (investment allocations), involve heightened emotions (retirement goals) or the value to the consumer is hidden (why save now?), and present an opportunity to drive behavior change (save more).

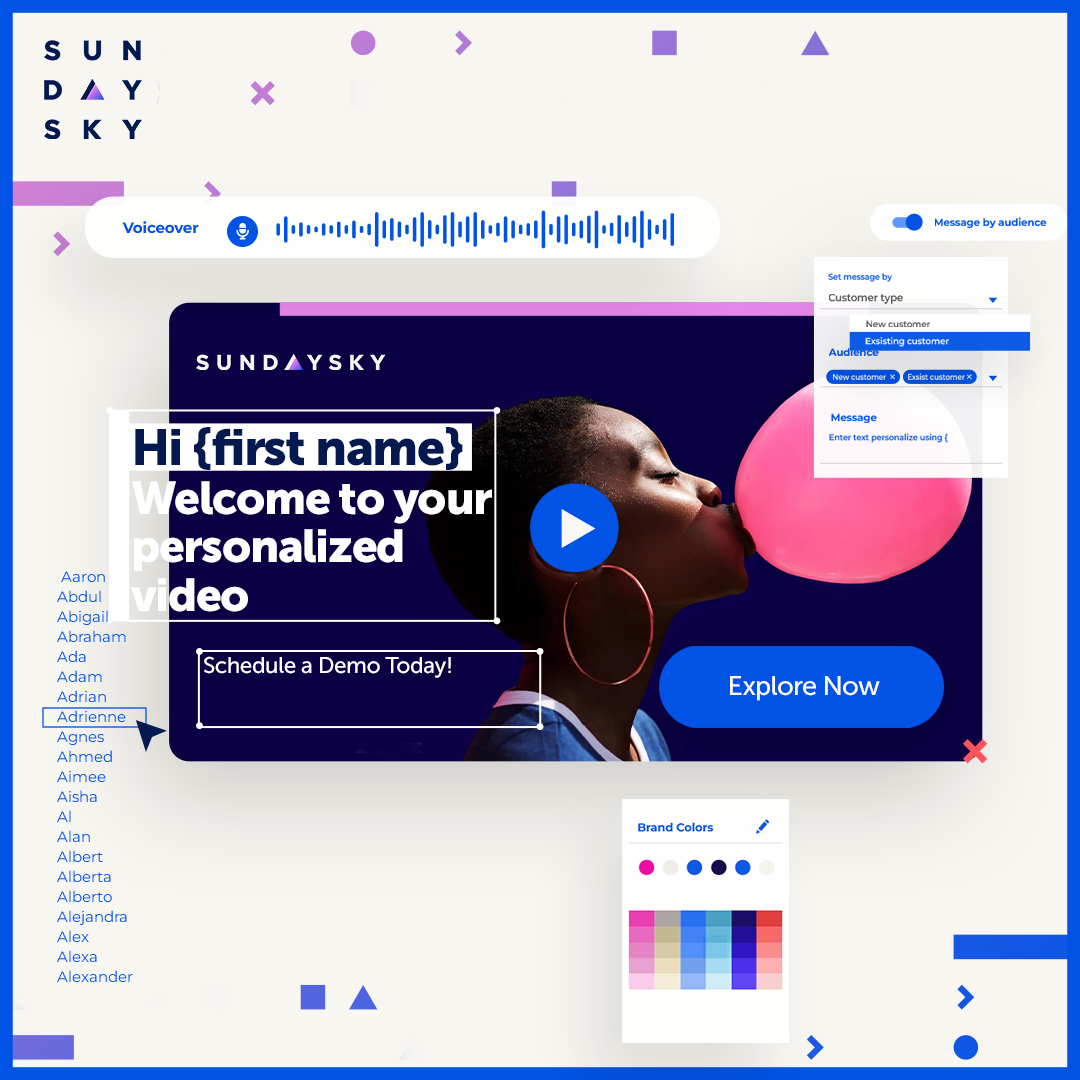

Video-powered experience’s ability to engage, empower and inspire action makes it uniquely suited to help your investors through those moments in their retirement journey. Here are five opportunities across the customer journey whereby video-powered experiences support retirement service institutions as they look to innovate the customer experience and drive breakthrough outcomes:

1. Pre-enrollment:

While most retirement services are brokered through employers, not all employees instantly enroll in a retirement plan upon hire or eligibility. Whether the reluctance is because of complexity, or lack of urgency, video-powered experiences can deliver an individualized message that helps move investors past initial hurdles to ‘enroll now,’ with step-by-step instructions and plan details.

2. Onboarding:

Once a customer has enrolled, there’s a small window of opportunity to welcome and educate investors on their new plan. Video-powered experiences should be provided within 1-3 days of enrollment and explain how a new plan works, benefit details, employee matching, provide an overview of digital tools and learning resources. The goal is to lay the foundation for each investor’s retirement confidence score, ultimately driving more security in pacing toward savings goals. View how T. Rowe Price uses individualized video-powered experiences to welcome new investors and recommend actions to grow their savings below:

3. Quarterly Review:

Help investors stay more in-tune with their savings’ status and pacing by delivering a quarterly financial review that offers a touch-base on goal tracking along with recommendations on the best actions to help achieve a savings goal. With this messaging, investors can make the needed changes early on in their savings journey, defusing the near-impossible challenge to play catch-up down the road.

4. Annual Summary:

Am I saving enough? Have I made the right updates to my contribution? An annual review via a video-powered experience is crucial to help investors debunk their doubt on savings progress and motivate them to continue contributing. Messaging can offer encouragement on the past year’s activity as well as recommended next best actions to take in the year ahead.

A video-powered experience is crucial to help investors debunk their doubt on savings progress and motivate them to continue contributing.

5. Account Update:

Whether a birthday, pay raise, marriage or childbirth, investors experience life changes, so retirement needs may change over time too. As investors make the necessary updates to their employment or family status in their retirement savings account, through video-powered experiences, retirement service institutions can proactively inform and educate each investor on the change implications as well as the recommended adjustments to make to their savings contribution work harder.

By leveraging personalized video experiences with account-level information to drive encouragement and timely next best actions, retirement service institutions can establish trust with their customers as they build their confidence in tracking toward retirement savings goals.