Have you ever found yourself in a moment of frustration wondering, “Will this be covered by my insurance?” or “How much will this cost me?” You’re not alone – only a meager 58% of healthcare members said they had a positive experience in regard to health insurer customer service related to plan uncertainties. As insurers work to address members’ needs when re-shaping their CX strategies, they must first consider the right communication moments, then adopt the same data, insights, and technology as other industries where net promoter scores are dramatically higher.

First consider the right communication moments, then adopt the same data, insights, and technology.

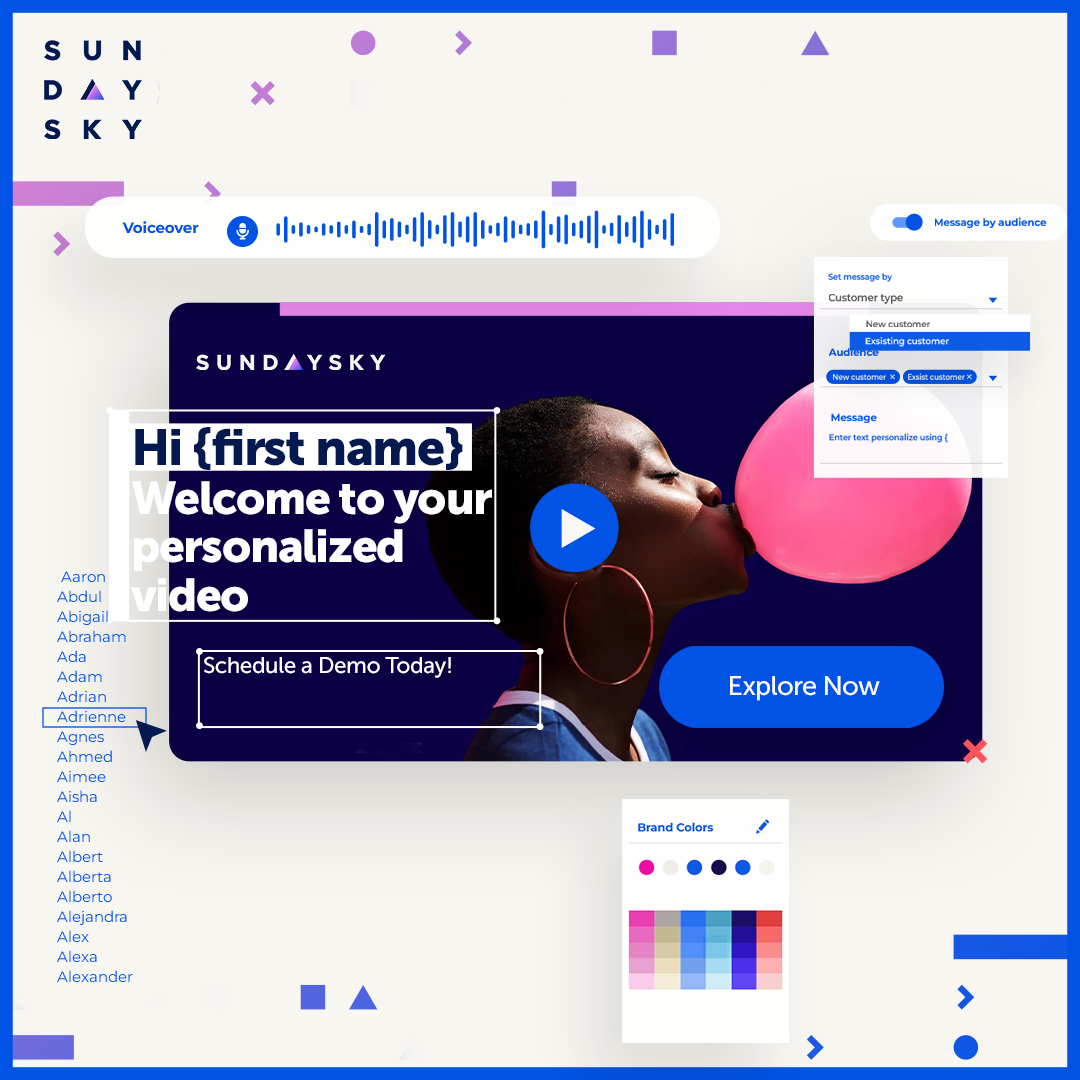

Leading health insurers that take a member-centric approach to their CX journeys using video-powered experiences reap the benefits of increased NPS and greater plan adherence. Below we identify three high-stakes moments for members where video-powered experiences can bridge the human and technology gap to improve customer experiences and drive breakthrough outcomes.

1. Moment of Consideration: Open Enrollment (First-time & Renewing Members)

The inherent complexity of healthcare plans can hinder member confidence in getting the most out of it. Considering the right plan to enroll in, understanding adherence guidelines, payment responsibilities, and the true value of healthcare services can quickly become a costly burden for both sides of the system. This makes open enrollment periods an opportunity for insurers to elevate themselves as a trusted partner in both first-time enrollment decisions and for members who re-enroll year after year.

Video-powered experiences are proven to help health insurance companies reduce call volume related to common open enrollment questions, drive digital plan enrollment, and increase digital tool adoption. Insurers can provide individualized education on how different plans work by outlining complex topics like co-pays, deductibles vs. premiums, in-network providers vs. out-of-network, urgent care visits, and more. Renewing members can also review their past plan, claims and usage to drive informed decisions for upcoming selections.

Video-powered experiences are proven to help health insurance companies reduce call volume.

2. Moment of Unfamiliarity: Plan Overview

Plan commencement generates an opportunity for insurers to nurture the member relationship into a partnership by proactively reducing new member pain points and “gotchas.” Whether it’s on the first day of the plan’s effective date or months after, extending a warm welcome with a video-powered experience to simplify and clarify plan coverage, drill deeper into coverage & adherence details, and drive preventative care actions decrease the cost-of-care for both members and insurers in the long run. Throughout the video-powered experience, individualized messaging can include cues like: find a network doctor, review your medical & pharmacy benefits, manage your HSA/FSA allocations, and look up common terms.

Whether it’s the member’s first log-in or their tenth, the video-powered experience can be easily accessed via the member portal and communicate up-to-date plan information such as how much money remains in their flex spending account or how close they are to meeting their deductible.

3. Moment of Frustration: Claims

Like in any industry, there are heightened emotions when it comes to finances and service-related billing. Simply put, members desire greater financial control, transparency and understanding to alleviate the burden of unexpected costs. By aligning to top call drivers, a video-powered experience can walk members through each component of their medical bill related to the claim amount.

By offering greater transparency and education on the complex claims process, SundaySky’s healthcare customers reported that 70-90%+ of their video viewers better understood their claims and no longer needed to call customer service.

To learn more about how video-powered experiences drive breakthrough outcomes at moments of consequence in the customer journey, download the United Healthcare success story here.