Financial Services Digital Marketing: 6 Key Trends to Watch in 2025

As we look ahead to 2025, the landscape of financial services digital marketing is set to undergo significant transformation. This already dynamic industry is on the brink of further advancement, particularly in the areas of personalization and video marketing. With customer expectations for tailored experiences and seamless interactions at an all-time high, financial services brands must leverage advancements in AI-driven marketing and create omnichannel customer experiences. By embracing these trends, financial institutions can effectively engage their audiences, foster trust, and achieve measurable results in an increasingly competitive environment.

This post explores the six financial services marketing trends expected to shape the industry in 2025. Continue reading for actionable insights on how you can leverage them to meet shifting customer demands.

The Evolving Landscape of Financial Services Digital Marketing

Today, consumer expectations are at an all-time high, with studies showing that 80% of customers now expect personalized services in their financial interactions. To remain competitive, financial institutions must not only keep pace with these trends but also anticipate future demands—all while navigating limited resources, tighter timelines, and constrained budgets. To position your company for success in 2025, it’s essential to understand the key financial services marketing trends that will reshape digital marketing in the financial services sector next year.

1. Personalization and Customer-Centric Marketing: How Can Financial Services Engage on a Personal Level?

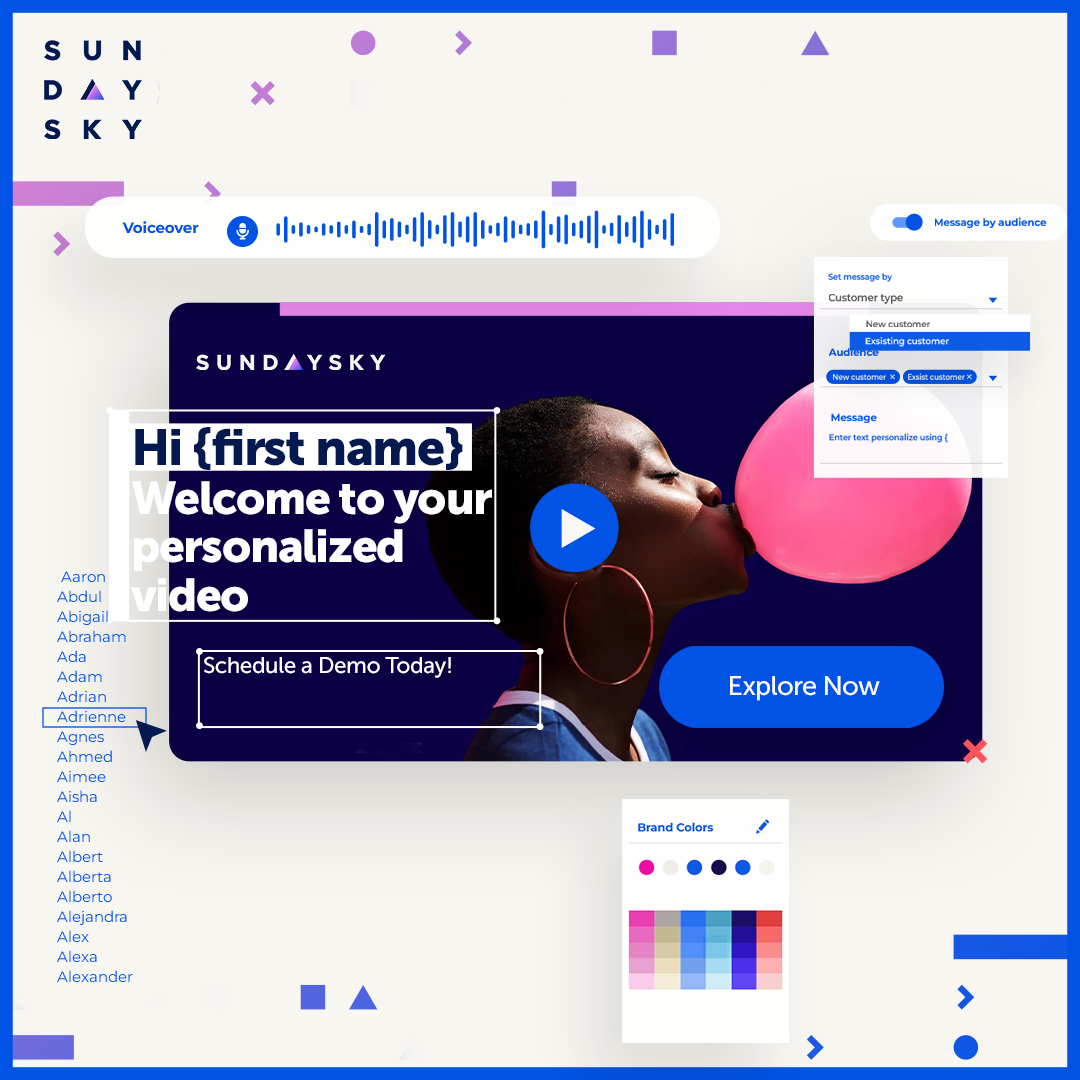

One of the most effective strategies for enhancing engagement and loyalty in financial services marketing is hyper-personalized experiences. With the power of artificial intelligence (AI), financial brands can create individualized journeys and customized content that resonate deeply with their customers.

By leveraging AI to analyze vast amounts of data, financial institutions can deliver targeted recommendations, offers, and content that align with each customer’s unique needs. This approach fosters customer-centric experiences that span from onboarding to loyalty programs, ensuring that personalized messaging strengthens relationships and makes customers feel valued.

For example, E*TRADE has successfully integrated personalization into its financial services marketing strategy through tailored onboarding video experiences. New customers receive a personalized welcome video that provides essential information on funding their accounts, utilizing digital tools for self-service, and more. By employing SundaySky’s AI video platform, E*TRADE has not only enhanced its onboarding experience but also achieved notable results, including a higher funding rate, an increase in net new assets, and improved average annualized revenue.

2. The Rise of AI and Automation in Financial Services Marketing: How Can Technology Enhance Customer Engagement?

AI and automation are changing the way financial marketers operate, enabling real-time, data-driven decisions that optimize campaigns and enhance customer interactions. Tools such as predictive analytics continuously refine marketing efforts by uncovering customer preferences and maximizing campaign impact. By identifying high-value prospects and upsell opportunities, AI-driven analytics empower financial brands to concentrate their efforts on leads most likely to convert.

Moreover, chatbots and virtual assistants provide around-the-clock support, addressing customer inquiries and significantly reducing wait times. By utilizing AI and automation, financial services marketing teams can engage customers in real-time and adapt campaigns to meet emerging needs, fostering a more responsive, customer-centric environment.

Bank of America creates and delivers summary videos of program activity to all its bank loyalty program clients. These annual videos, created on the SundaySky platform, provide transparency about rewards earned and available benefits, enhancing customer understanding and engagement.

3. Data Privacy, Compliance, and Trust Building: How Can Financial Brands Balance Personalization and Privacy?

As the volume of personalized data increases, data privacy and security have become critical factors in gaining and retaining customer trust. Financial brands that prioritize ethical data practices can gain a significant competitive advantage in this landscape. Staying up to date with compliance regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is essential for maintaining transparency in data collection and storage.

To build trust, financial services brands should implement clear messaging around their data practices and emphasize their commitment to data security in financial services marketing and communications. Being transparent about what data is collected and how it is utilized not only fosters customer trust but also differentiates your brand in a crowded marketplace. By prioritizing ethical data practices, financial institutions can create lasting relationships with their customers, ensuring a strong foundation for future growth.

4. Content Marketing and the Power of Video for Financial Services: Why is Video Marketing Essential in 2025?

Video has emerged as an invaluable asset in financial content marketing, offering a dynamic way to simplify complex topics and forge connections with audiences. Video tutorials on financial literacy—such as “Understanding Mortgages” or “Basics of Investing”—provide valuable insights to customers and establish brand authority.

Additionally, product demos, explainer videos, and thought leadership content serve as powerful tools for financial services to make a lasting impact. Personalized onboarding videos can guide new customers through setup and initial interactions, effectively reducing drop-off rates by streamlining intricate processes.

Recently, recap videos have been rising in popularity, offering a captivating way to engage audiences and boost customer loyalty. To further enhance financial services marketing strategies, download this free eBook and discover how to create captivating customer recap videos—an essential addition to your marketing toolkit.

5. Embracing Omnichannel Marketing and Seamless Financial Services CX: How Do Financial Brands Deliver a Consistent Experience?

A cohesive, omnichannel experience is now essential for building brand trust and ensuring customer satisfaction. To deliver a seamless customer experience across various touchpoints, financial institutions should utilize a combination of channels, including mobile apps, email, websites, and social platforms.

Within these channels, maintaining a unified message is crucial, so customers receive a consistent brand experience, no matter where they interact with the company. Be sure to optimize content for mobile platforms which will be increasingly important to cater to customers’ on-the-go needs as mobile banking continues to expand.

For instance, T. Rowe Price effectively integrated personalized video into its 401(k) marketing and client engagement strategy using the SundaySky platform. These videos focus on key touchpoints, from account onboarding and contribution education to account check-ins and security tips. Regardless of when or where customers view their personalized T. Rowe Price video, they experience consistent, on-brand messaging for a unified experience.

6. Measuring Success with Advanced Analytics: Which Financial Services Marketing Statistics Matter Most?

In a data-driven world, understanding the metrics that matter is key to assessing digital marketing success and refining strategies. Focus on key financial services marketing statistics such as customer lifetime value (CLV), conversion rates, and engagement scores. These indicators reveal campaign effectiveness and long-term customer value.

Real-time analytics enable financial institutions to adjust campaigns on the fly, quickly responding to emerging trends and customer behavior. By evaluating performance across channels, financial services can refine targeting, budgeting, and allocation strategies, achieving higher returns on marketing investments.

With advanced financial services marketing statistics, your brand is now better equipped to measure what’s working and make data-backed adjustments that optimize marketing outcomes.

Bank of America measured the success of its personalized video program, saying:

“We see feedback where clients tell us the video helped them understand the program much better. As a result of that greater understanding, they engage deeper and bring in more assets to move up the ladder in the program.” — John Sellers, Preferred Rewards Executive, Bank of America

Preparing for 2025 and Beyond: How Can Financial Services Stay Competitive?

As digital marketing in financial services continues to evolve, brands must adopt a flexible, customer-first approach. By embracing personalization, investing in AI, upholding ethical data practices, expanding content marketing, fostering omnichannel experiences, and utilizing advanced analytics, you can stay ahead of customer expectations.

With these financial services marketing trends in mind, marketing teams are poised to become more agile, successfully creating more meaningful experiences with customers and paving the way for a secure, personalized, and connected future in financial services.

To build a strong financial services marketing strategy, begin by downloading the 4 Must-Have Videos Your Banking Business Needs. This eBook provides essential video use cases that are designed to help you grow and retain your customer base so you are set up for success in 2025 and beyond.