In today’s insurance environment, where features and prices can be quickly matched by competitors, customer experience is a primary driver of differentiation. To maintain a competitive advantage, carriers must become customer-centric and develop business models that respond to these rapid changes with new services and approaches.

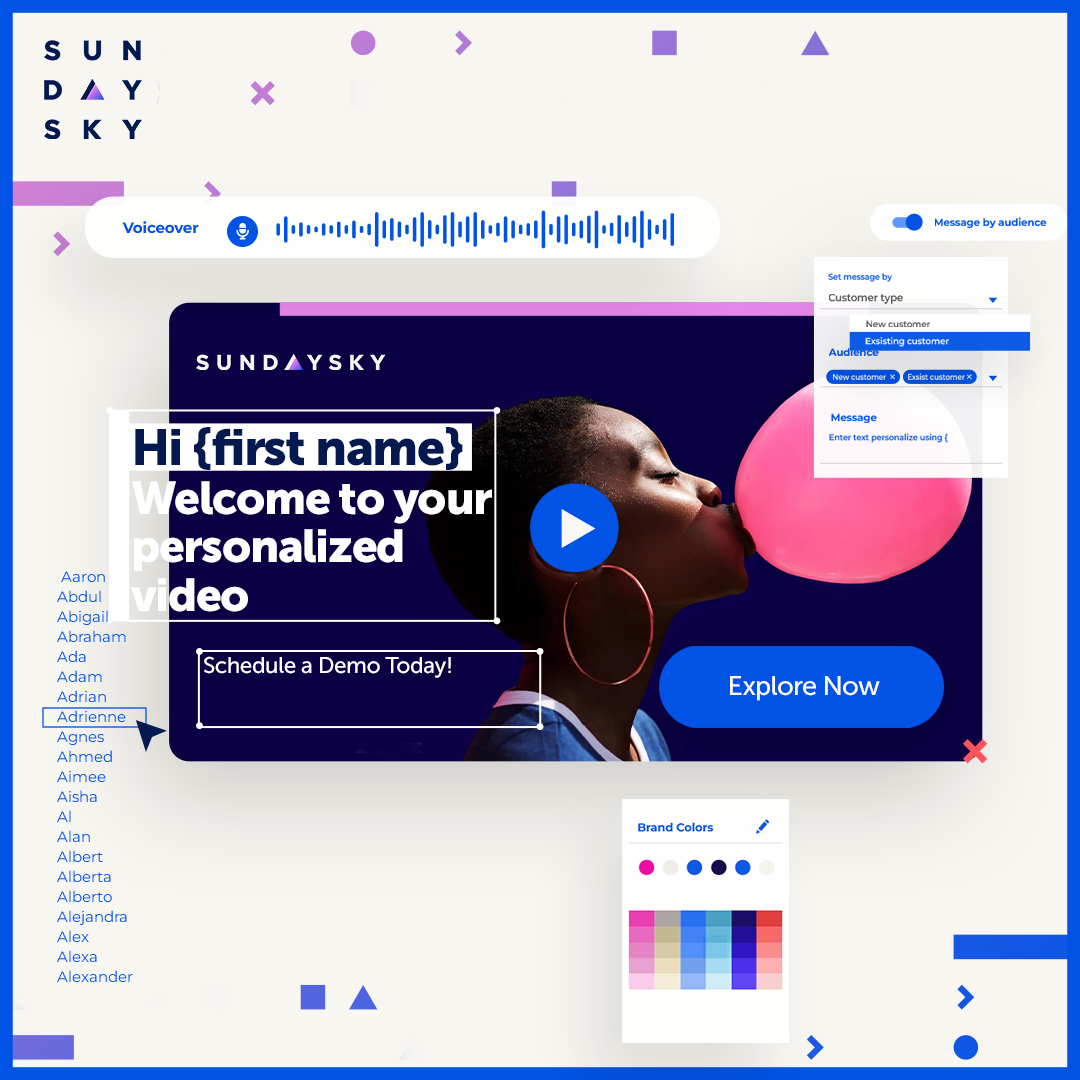

We’ve partnered with Accenture to help life insurance and annuity carriers stay top-of-mind and better engage their customers in the digital age (read the full press release here). Through the Accenture Life Insurance Platform (ALIP), insurance carriers can deliver engaging and effective personalized videos to welcome, support and retain consumers throughout the customer lifecycle.

“Integrating SmartVideo technology into ALIP will change the way carriers communicate with their customers and help foster engagement and increase brand loyalty,” said Shay Alon, global managing director, Accenture Software for Life and Annuity. “Our new SmartVideo complements Accenture’s life insurance and annuity offerings by enabling carriers to create unique digital experiences while reducing contact center and operational costs.”

With a data-driven, storytelling approach, Accenture’s life insurance and annuity providers can proactively address the complexity of a consumer’s account information with a highly engaging experience. Personalized videos are tailored to each customer, and contain historical or situational attributes such as account coverage, program features, claims details and value-added services in order to provide relevant information at a specific point in time.

SmartVideo ensures providers are delivering the right message, at the right time, on the right channel, to create brand loyalty while also driving results that matter to the business. With more targeted calls to action, carriers can see a 10 to 20 percent reduction in customer care expense, given deflection and reduced duration of related inbound calls.